The advent of Opportunity Zones (OZ) offers players in the private finance and real estate communities a new way to enjoy tax incentives while helping economically distressed areas. Recently, the IRS and the Treasury Department provided new guidance impacting investments into Opportunity Zones, and requested public comment by July 1.

Enacted as part of the Tax Cuts and Jobs Act at the end of 2017, the OZ tax benefit was designed to facilitate capital investment by qualified opportunity funds (QOFs) into low-income and distressed areas designated as opportunity zones. Taxpayers that invest in QOFs are permitted to defer (and in some cases, reduce or eliminate) capital gains tax liability.

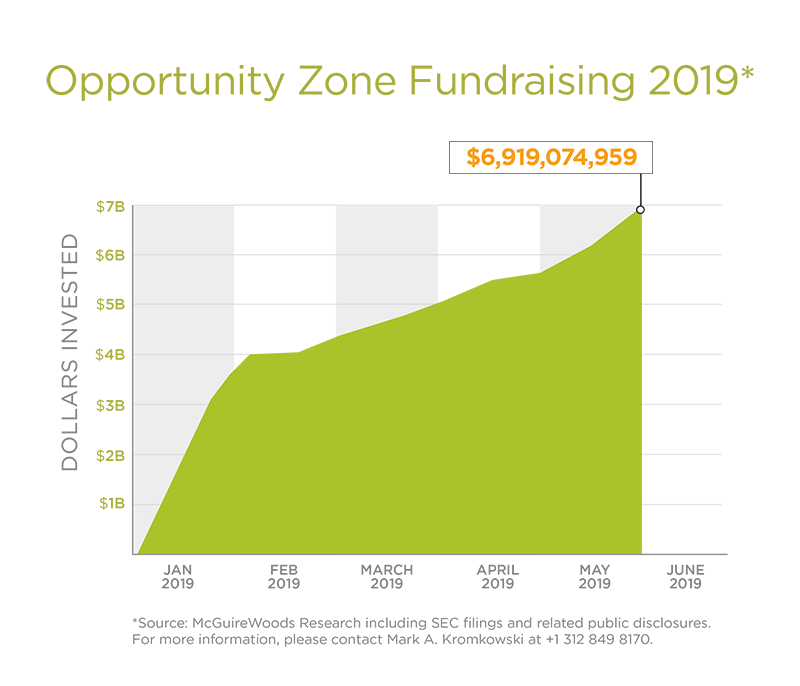

McGuireWoods’ research, based on SEC filings and related public disclosures, shows fundraising with respect to investments in OZs has reached $6.9 billion for the first five months of 2019.

Our dedicated OZ team guides clients on the specific details and helps them work through vital decisions for initial investments into qualified opportunity funds, as well as the execution of the funds into development projects. Recent guidance from April 2019 provided the needed framework and path forward for increased investments into these qualified opportunity funds, as demonstrated by increased fundraising through the end of May 2019.

Although there can be no certainty that all of these dollars will be deployed, the OZ team at McGuireWoods is dedicated to keeping clients advised of new legislative and business developments as they occur.

Public Comment PeriodThe IRS and Treasury Department have requested public comment on further specifics of the OZ tax benefit, qualified opportunity zone funds and businesses, reporting requirements, further guidance on the anti-abuse rules, and the original use requirement. Such comments must be submitted no later than July 1, 2019. While some narrower questions remain, the outlined regulations from April 2019 alleviated many of the concerns presented to the investment community and have provided sufficient guidance for investors, developers and funds to continue moving forward with OZ-eligible projects. McGuireWoods’ OZ team will provide updates on any new guidance developing from the public comment process.

If you have any questions regarding Opportunity Zones, fundraising and development, or the recent IRS and Treasury Department guidance, please contact one of the authors noted below or your primary attorney at McGuireWoods.