Bank Defense and Counseling

When the government investigates, banks need skilled defense counsel who know the industry and can navigate these matters to resolution. McGuireWoods defends and counsels banks in their most sensitive, high-stakes matters.

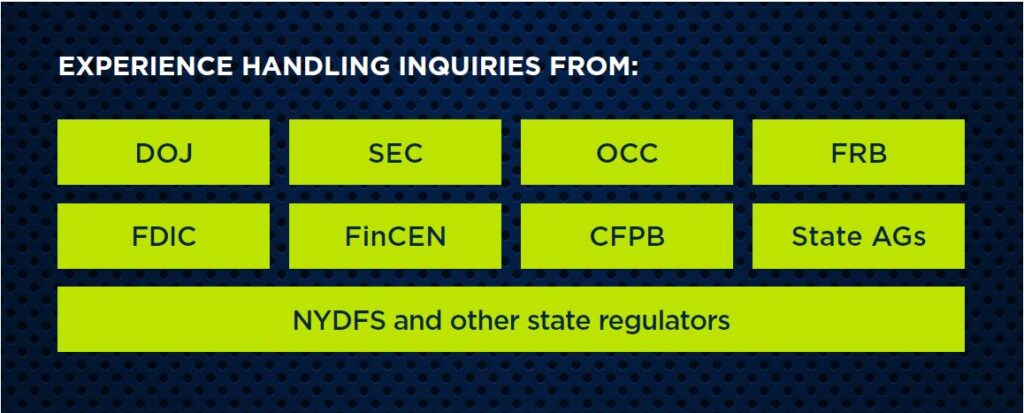

Our Bank Defense and Counseling team includes seasoned lawyers who defend the world’s largest banks in inquiries by the Department of Justice, SEC, OCC, FRB, CFPB, FDIC, state attorneys general, and several other regulators. Our successes have led to repeated recognition as a Banking Practice Group of the Year and White Collar Practice Group of the Year. With experience in nationwide securities fraud investigations, OCC enforcement actions alleging unsound banking practices, data breaches, and defense of banks in BSA/AML-related inquiries, our Bank Defense and Counseling lawyers have been there. Over the past 20 years, McGuireWoods has built strong relationships with government lawyers and earned a reputation for knowing how to navigate the life cycle of a large-scale investigation.

The complexity of large investigations, often involving multiple agencies and significant public attention, requires counsel who know the banking industry and the regulators that govern it.

- We have defended national banks in multi-year enforcement actions by DOJ, SEC, OCC, and attorneys general.

- We have developed and implemented comprehensive compliance programs for several banking clients and their subsidiaries.

- We have trained a national bank’s entire investigations workforce on conducting effective internal investigations.

- We have defended banks in several enforcement matters regarding BSA/AML compliance.

- We have represented bank clients in matters involving the largest Ponzi schemes in history.

In every matter, we understand the heightened privacy concerns and risk-based planning unique to our bank clients, and we keep these issues top of mind when advocating on their behalf.

About Our Team

McGuireWoods’ Bank Defense and Counseling team is part of an elite Government Investigations & White Collar Litigation Department with decades of bank-related experience. We hold a robust presence in all the major U.S. banking markets and have been recognized as a Law360 White Collar Practice Group of the Year. The firm also has been recognized as a Banking Practice Group of the Year. With decades of experience handling investigations and litigation in the banking sector, our Bank Defense and Counseling team includes former senior enforcement officials from a variety of governmental agencies, including the DOJ, SEC, OCC, and FINRA. We also draw upon the acumen of seasoned litigators in our Financial Services Litigation, Business Securities Litigation, and Complex Commercial Litigation departments, as well as our financial institutions industry team, our broker-dealer team, and our SEC enforcement team. McGuireWoods leverages experience across the full spectrum of regulatory, compliance, and business issues to ensure our banking clients receive well-tailored advice and a comprehensive defense team to handle the many complex issues presented in government inquiries.

How We Help

Given this special combination of skills, experience and relationships, McGuireWoods’ Bank Defense and Counseling team helps clients develop successful strategies to navigate high-stakes investigations to resolution. From the receipt of a grand jury subpoena or supervisory letter to a full-blown investigation with significant media interest, we gauge the potential legal, business and reputational consequences, counseling clients on charting the best path forward to resolve the issue while avoiding damaging missteps.

Our team also helps banking clients limit the collateral consequences of government investigations by developing strategies to reduce and address the impact on licensing, private litigation and potential criminal exposure. In collaboration with McGuireWoods’ strategic risk and crisis management group, the Congressional Investigations team and McGuireWoods Consulting, we manage ancillary issues associated with bank investigations, including congressional investigations, board and shareholder relations, media inquiries and other crisis management matters.

National banks, regional banks, credit unions, senior executives and boards of directors call on McGuireWoods to handle a range of matters in the investigations arena, including:

- Coordinating the defense and response to grand jury and related investigations into banks’ operations, compliance structures, and allegations of employee and customer misconduct

- Conducting internal investigations and presenting to government counsel and bank regulators’ supervisory and enforcement staffs regarding investigation progress and findings

- Preparing witnesses for government interviews and testimony

- Training legal and investigations personnel on all aspects of internal and government-facing investigations

- Directing media and public relations and developing crisis management strategies

- Overseeing board and shareholder relations, litigation, and other ancillary matters

Representative Matters

- Defended a national bank in multiyear enforcement actions by the DOJ, SEC, OCC and multistate attorneys general into issues involving allegations of securities fraud and falsification of records.

- Represented national bank and litigation target in $1 billion Ponzi scheme fraud in Southern District of Florida in federal investigation and related investor litigation.

- Represented a national bank in connection with an internal and DOJ investigation into suspicious activity reporting and fraud conducted through the bank.

- Represented a national bank in a DOJ investigation into fraud and elder abuse allegations.

- Represented multiple banks in enforcement actions and inquiries into BSA/AML compliance and SAR reporting requirements.

- Conducted an internal investigation into issues impacting a national bank’s compliance with an OCC consent order.

- Trained a prominent national bank’s entire investigations workforce on conducting effective and efficient internal investigations.

- Defended servicer in CFPB enforcement action related to marketing service agreements and allegations of deceptive practices, RESPA, FCRA and Regulation N violations.

- Represented a financial institution in a securities fraud case in which the plaintiffs alleged that the company, and specifically its CEO and CFO, made fraudulent statements about the adequacy of certain reserves.

- Defended financial institution against OCC enforcement inquiry including regular discussions with Commission counsel and coordination of company’s response.

- Represented a half-dozen employees of a major financial institution in responding to a CFPB investigation into alleged kickbacks between a lender and a title company in violation of RESPA.

- Defended numerous financial institutions in connection with Ponzi and pyramid schemes perpetrated by account holders resulting in enforcement actions and investigations by DOJ, OCC, SEC and FinCEN.

- Developed and led an innovative litigation and crisis management team for one of the world’s largest financial institutions that allowed them to avoid significant legal, political, and reputational risk.

- Represented a financial institution in more than 40 FINRA arbitrations worth more than one billion dollars in damages.

- Conducted internal investigation and response to regulatory inquiries into alleged employee misconduct at a large financial institution, leading a team conducting more than 700 employee interviews over a two-month period.

- Conducted internal investigations for financial institutions regarding proactive company compliance and government enforcement actions.

- Represented financial institutions in responding to data breaches, including internal investigation, crisis management, notice requirements and responding to congressional inquiry.

- Serve as outside privilege and discovery counsel to a large national bank.

Download copy of our practice brochure.