On March 25, 2015, Virginia Governor Terry McAuliffe signed into law Chapter 389 of the 2015 Acts of Assembly (the Amendments). The Amendments modify Virginia’s existing laws regarding property assessed clean energy (PACE). Most notable among the modifications are the provisions supporting commercial PACE projects that allow for the imposition of a voluntary special assessment lien.

PACE in Virginia and How it Should Work

Prior to the Amendments, Virginia’s statute lacked certain provisions found in other states’ laws that make PACE an attractive form of financing. For instance, under the prior Virginia statute, PACE provided a property owner a means to finance eligible improvements, such as “distributed generation renewable energy sources” or “energy efficiency improvements” with a loan secured by a lien on the improvements sized to the value of the loan. The collection of those loan payments could be accomplished through a variety of means, including real property tax assessments or a locality’s utility services billing (i.e., “on bill” financing).

Under the Amendments, a voluntary special assessment lien on commercial or multi-family buildings is allowed subject to the qualifications that are addressed below. The Amendments affect voluntary special assessment liens only on buildings “other than a residential dwelling with fewer than five dwelling units or a condominium project” as defined in Section 55-79.2 of the Code of Virginia of 1950, as amended. The Amendments do not affect current law with respect to single-family residences; however, the Amendments do add a new category for water efficiency improvements available to any property owner. Specifically, the eligible improvements are now modified to include “energy usage efficiency,” “water usage efficiency” and “renewable energy production and distribution facilities.”

Steps to Secure a PACE Loan

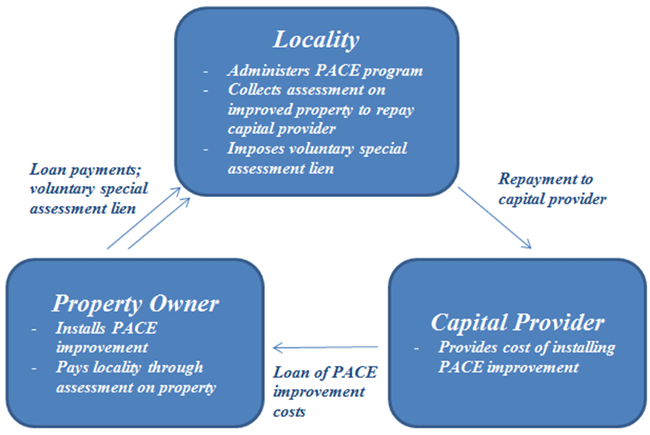

The typical steps to financing a PACE improvement are shown below.

- A locality creates a PACE program, identifies lenders or other sources of capital willing to participate and considers whether to hire a third party to administer the program.

- A property owner desiring to add a PACE-qualifying improvement to the property applies to the locality for PACE financing.

- The owner and the locality’s PACE program work with the sources of capital to obtain the requisite approvals and negotiate applicable terms.

- The property owner receives the capital and installs the PACE improvement and the locality imposes the special assessment.

- The locality is repaid from the special assessment on the property and remits those repayments to the capital provider.

Here is a conceptual diagram showing the relationships of the capital provider, locality and property owner in a program without a third-party administrator:

Click here to view chart full size.

Authorization of “Voluntary Special Assessment” Liens for Commercial PACE Projects

Under the prior statute, the lien of a PACE loan was equal to the value of the PACE loan, was placed on the underlying property and was junior to any existing mortgage holder. The Amendments now allow for commercial PACE improvements to be repaid from a “voluntary special assessment.” The lien on the voluntary special assessment will have equal priority with a property tax lien against real property and may have priority over pre-existing mortgage liens so long as the existing lender consents. The Amendments also stipulate that the PACE liens “run with the land,” meaning the liens remain in full force and effect until paid regardless of any transfer of ownership.

The goal of the changes is to improve the underlying credit of the loan through the ability to recoup the voluntary special assessment. The special assessment is the means by which a locality recovers the costs of the PACE improvement over the life of the asset. The Amendments permit a locality to contract with a third-party program administrator and to pass the costs of administration to the property owner. As a result, the locality may enforce delinquent installments of the voluntary special assessment in the same manner as a delinquent real property tax payment.

Lender Consent Requirements

The Amendments contain a “lender consent” provision. Before a property owner may obtain a PACE loan with priority over existing mortgage liens, the existing mortgage lienholder must consent to the PACE loan by signing a subordination agreement. PACE loans are designed to enhance the value of the asset by funding improvements that generate savings or revenues equal to or greater than the loan payments. Significantly, before consenting to a PACE loan, an existing creditor is able to vet projects in advance and exercise a unilateral veto over projects that may decrease property value or cash flow.

Growth to Date; Benefits of PACE

Other states have previously implemented commercial PACE programs. In New York, a major financial institution has committed $75 million to commercial PACE projects. (See Energy Improvement Corporation Announces Agreement…) Connecticut recently securitized over $30 million of its commercial PACE loans with a private lender. (See CEFIA Announces Sale of Commercial Property Assessed Clean rel=”noopener noreferrer” Energy Benefit Assessment Liens.) PACENow (http://www.pacenow.org/), a nonprofit group tracking the development of PACE, reports rel=”noopener noreferrer” a pipeline of over $400 million in commercial projects nationwide. (See PACENow December Market Update.) PACE is intended to provide a number of benefits to both lenders and property owners:

- The improvements can increase the value of the improved property through increased cash flows of the property, allowing borrowers to invest in other improvements or new projects.

- Because the lien on the improvement runs with the land, loan terms can be longer, helping to keep rates competitive.

- Increased demand for capital improvements spurs local economic development and creates jobs.

- Capital providers can rely on a strong underlying credit: a special assessment levied by the locality.