On Feb. 26, the Financial Industry Regulatory Authority issued Regulatory Notice 18-08 seeking comment on a proposed new rule to address outside business activities of registered persons. The proposal, a result of FINRA’s retrospective rule review, seeks to modernize and simplify existing FINRA rules governing outside business activities (OBAs) and private securities transactions (PSTs). It offers significant changes to broker-dealers’ obligations relating to outside business activities.

The proposed rule seeks to: (1) consolidate existing Rules 3270 and 3280, which currently govern registered persons’ OBAs and PSTs of associated persons, (2) clarify member firms’ obligations vis-à-vis these activities, and (3) allow firms to appropriately focus their resources on outside activities that pose more risk to customers.

The proposed rule could be transformative for the broker-dealer (BD) industry, particularly those firms whose registered representatives are also engaged in investment adviser (IA) activities. It offers regulatory relief to firms while allowing them to focus review and supervision over outside activities that are investment-related and would be the most likely to create risk for both investors and the firms.

FINRA Rule 3270 prohibits registered persons from engaging in OBAs — activities outside the scope of a registered person’s relationship with his or her member firm — unless they provide prior notice to the firm. Rule 3280 prohibits associated persons from engaging in PSTs or from “trading away” from the firm, without prior notice and consent from the firm. As FINRA discussed in the Notice, these rules provide important protections for customers and the firms.

Among other things, for an OBA (non-securities or non-investment-related activity), the rule protects customers who may mistakenly believe that a broker is operating within the scope of his employment when he is in fact performing an outside business activity. For example, a customer may be confused by a broker who also maintains a tax practice and provides tax advice, mistakenly believing that this tax advice is endorsed by the member firm. Further, as many enforcement cases have shown, frequently an OBA (e.g., selling non-variable insurance products) can become securities-related if the products or activity evolves in that direction. Regarding PSTs, both customers and the firms are protected because of supervisory and other regulatory obligations that come into play with these transactions.

The need for this type of holistic overhaul of the OBA and PST rules is critical for a host of reasons, including industry confusion resulting in inconsistent implementation and ineffective resource allocation. First, FINRA’s most comprehensive guidance in this area (Notices to Members 94-44 and 96-33) is over 20 years old. For dual registrants (BD/IA) or firms that permit their brokers to affiliate with outside registered investment advisers, this has led to firms applying the rules differently, particularly surrounding their supervisory responsibilities for dual registrants’ investment advisory activities conducted away from the firm and whether other regulatory obligations under FINRA rules apply to those activities. Second, the OBA rule requires firms to expend resources on reviewing outside business activities that create minimal, if any, risk of customer confusion (e.g., a broker playing in a wedding band). Further, these requirements also have led to FINRA expending examination resources testing for compliance when its resources would be more effectively focused elsewhere.

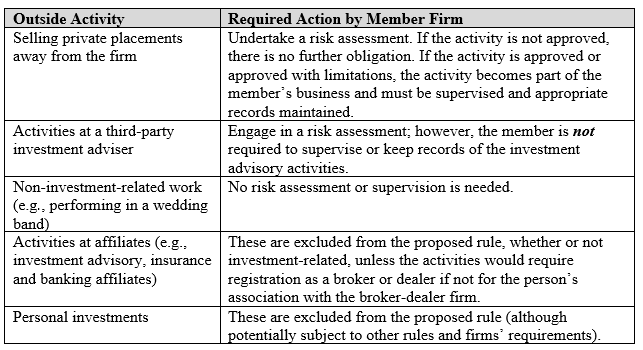

The proposed rule would require registered persons to provide their firms with prior written notice of all outside business activities, whether investment-related or not. The action the firm must take upon receipt of the written notice depends on the nature of the business activity, as illustrated below:

This sliding scale of required actions simultaneously clarifies firms’ responsibilities while allowing them to more effectively direct resources to supervise outside activities that potentially pose higher risk of customer harm and risk to the firm. The proposed rule focuses members’ responsibilities on investment-related activities; if an activity is not investment-related, then a firm has no further obligations under the rule. Where the outside activity is investment-related, the firm would be required to conduct a risk assessment to evaluate whether the proposed activity will: (1) interfere with or otherwise compromise the registered person’s responsibilities to the firm’s customers; or (2) be viewed by customers or the public as part of the firm’s business.

Perhaps most notably, under the proposed rule, any investment-advisory activity conducted on behalf of a dually registered BD/IA, or for an investment adviser affiliate of a member, would not trigger supervisory responsibilities for the member firm. Indeed, firms would have supervisory obligations over outside activities in only two scenarios. First, if the member imposes conditions or limitations on a registered person’s participation in an investment-related activity, the firm must supervise to ensure compliance with those conditions or limitations. Second, if the firm approves an activity that would require the registered person to register as a broker-dealer under the Securities Exchange Act were it not for the person’s association with a firm, then the activity is deemed the firm’s business and must be supervised by the firm. As FINRA explained in its proposal, “if the person can only legally engage in the outside business activity because the person is associated with a member, the member approving the activity must treat it as its own.” These changes represent a departure from Rule 3280, which FINRA said created “significant confusion and practical challenges.”

As noted, FINRA’s proposed rule offers sweeping changes: (1) significant clarification in an area that has confused many in the industry for a very long time, (2) a streamlined approach, and (3) potential relief from burdensome supervisory responsibilities over registered representatives’ outside business activities that pose little risk to investors. The proposed rule will also free up FINRA to focus its exam and enforcement resources on areas of higher potential risk and harm rather than having to address technical OBA and PST deficiencies. Given the transformation of the financial services industry, the proposed amendments will help modernize the regulatory obligations these firms face and recognize the multiple regulatory regimes in play. Avoiding duplicative regulation is a plus for all stakeholders, including the regulators.

Recognizing that there are many different considerations at play, FINRA seeks comments on a host of issues (specifically, posing over 20 questions for discussion) related to the proposed rule, including: (1) whether the rule should be expanded to apply to all associated persons, (2) whether proposed exclusions to the rule are appropriate, and (3) whether the rule’s elimination of firms’ general supervisory obligation over investment-advisory activities will undermine investor protection. These questions demonstrate that FINRA is continuing to evaluate the appropriate method for regulating outside business activities, while providing the industry an opportunity to provide additional input.

For further information, contact the members of the McGuireWoods BD-IA team.